FAQ

How to File a Corporate Transparency Act Report: FAQ

Comprehensive Guide for Beneficial Ownership Information Reporting

Please note that the information provided here is for clarification purposes only and does not modify any legal obligations as defined by statutes or regulations. For comprehensive details, please refer to the Beneficial Ownership Information Reporting Rule at FinCEN.

A. General Questions

Beneficial ownership information includes the identifying details of individuals who have direct or indirect control or ownership of a company.

In 2021, Congress enacted the Corporate Transparency Act with broad bipartisan support. This legislation establishes a new requirement for reporting beneficial ownership information. It is a key measure in the U.S. government’s strategy to prevent individuals from concealing or exploiting illicit gains through the use of shell companies or obscure ownership structures.

FinCEN will allow access to beneficial ownership information for Federal, State, local, and Tribal officials, as well as specific foreign officials who submit requests through a U.S. Federal government agency, for authorized activities related to national security, intelligence, and law enforcement. Financial institutions will also have access under certain conditions, provided they have the consent of the reporting company. Additionally, the regulators of these financial institutions will have access to beneficial ownership information when performing supervisory duties.

On December 22, 2023, FinCEN published the rule governing access to and protection of beneficial ownership information. This information will be securely stored in a non-public database, employing stringent information security measures and controls used by the Federal government for protecting sensitive, non-classified information systems at the highest security level. FinCEN will collaborate closely with authorized users to ensure they understand their responsibilities in using the information strictly for authorized purposes and handling it in a manner that maintains its security and confidentiality.

FinCEN is actively conducting a comprehensive outreach and education initiative to increase awareness and assist reporting companies in understanding the new reporting requirements. This initiative includes a combination of virtual and in-person events, and provides thorough guidance across multiple formats and languages. Resources include multimedia content, the Small Entity Compliance Guide, and outreach through new communication channels such as social media. Additionally, FinCEN is collaborating with federal and state government offices, small business associations, trade groups, and various interest organizations to effectively disseminate information and support compliance efforts.

B. Reporting Process

A reporting company that was created or registered to conduct business before January 1, 2024, has until January 1, 2025, to submit its initial beneficial ownership information (BOI) report.

A company established or registered in 2024 must file its BOI report within 90 calendar days after receiving either actual or public notice confirming its creation or registration.

For companies created or registered on or after January 1, 2025, the deadline to file the BOI report is within 30 calendar days from the date they receive actual or public notice that their creation or registration is effective.

A reporting company established or registered to conduct business before January 1, 2024, has until January 1, 2025, to file its initial beneficial ownership information report.

A reporting company created or registered on or after January 1, 2024, and before January 1, 2025, must file its initial BOI report within 90 calendar days of receiving notice that the company’s creation or registration is effective. This 90-day period begins from the date the company receives actual notice of its creation or registration or when a secretary of state or similar office provides public notice, whichever occurs first.

Reporting companies created or registered on or after January 1, 2025, are required to submit their initial BOI reports to FinCEN within 30 calendar days of receiving either actual or public notice confirming their creation or registration.

FinCEN will start accepting beneficial ownership information reports on January 1, 2024. Reports submitted prior to this date will not be accepted.

Any individual authorized by the reporting company, such as an employee, owner, or third-party service provider, is permitted to file a beneficial ownership information (BOI) report on behalf of the company. When submitting the BOI report, filers should be prepared to provide their basic contact information, including their name, email address, and phone number.

C. Reporting Company

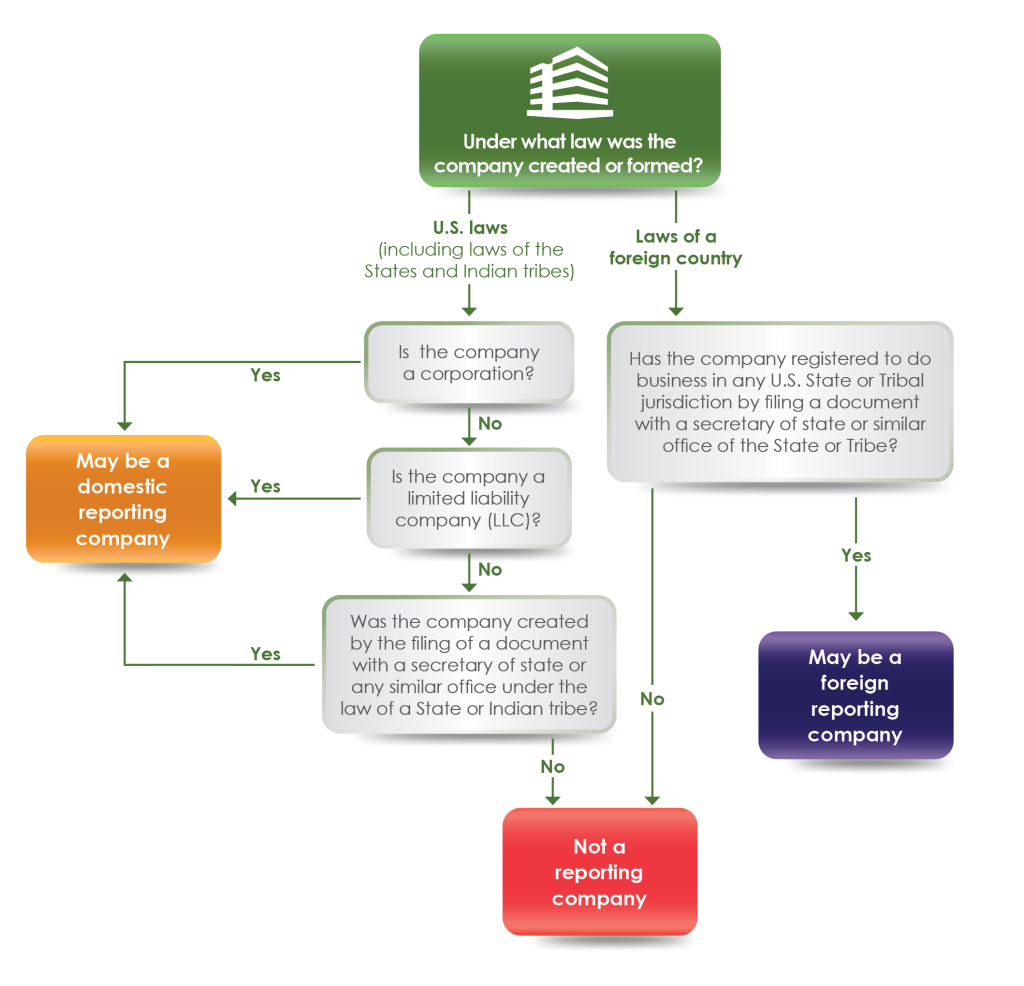

Companies required to report beneficial ownership information are referred to as reporting companies. There are two main categories of reporting companies:

-

Domestic Reporting Companies: These include corporations, limited liability companies (LLCs), and other entities established by filing a document with a secretary of state or a similar office within the United States.

-

Foreign Reporting Companies: These are entities, such as corporations and LLCs, formed under the laws of a foreign country, which have registered to conduct business in the United States through the filing of a document with a secretary of state or an equivalent office.

There are 23 types of entities that are exempt from these reporting requirements (refer to Question C.2). It is essential to thoroughly review the qualifying criteria to determine if your company qualifies for an exemption.

FinCEN’s Small Entity Compliance Guide for beneficial ownership information reporting includes a flowchart to help determine whether a company is a reporting company (see Chapter 1.1, “Is my company a ‘reporting company’?”).

Yes, there are 23 types of entities that are exempt from the beneficial ownership information reporting requirements. These entities include publicly traded companies meeting specified criteria, many nonprofits, and certain large operating companies.

The following table summarizes the 23 exemptions:

| Exemption No. | Exemption Short Title |

|---|---|

| 1 | Securities reporting issuer |

| 2 | Governmental authority |

| 3 | Bank |

| 4 | Credit union |

| 5 | Depository institution holding company |

| 6 | Money services business |

| 7 | Broker or dealer in securities |

| 8 | Securities exchange or clearing agency |

| 9 | Other Exchange Act registered entity |

| 10 | Investment company or investment adviser |

| 11 | Venture capital fund adviser |

| 12 | Insurance company |

| 13 | State-licensed insurance producer |

| 14 | Commodity Exchange Act registered entity |

| 15 | Accounting firm |

| 16 | Public utility |

| 17 | Financial market utility |

| 18 | Pooled investment vehicle |

| 19 | Tax-exempt entity |

| 20 | Entity assisting a tax-exempt entity |

| 21 | Large operating company |

| 22 | Subsidiary of certain exempt entities |

| 23 | Inactive entity |

FinCEN’s Small Entity Compliance Guide includes this table and provides checklists for each of the 23 exemptions to help determine whether a company meets an exemption (see Chapter 1.2, “Is my company exempt from the reporting requirements?”). It is crucial for companies to thoroughly review the qualifying criteria before concluding that they are exempt. For additional FAQs about reporting company exemptions, refer to “L. Reporting Company Exemptions” below.

It depends. A domestic entity, such as a statutory trust, business trust, or foundation, is considered a reporting company only if it was created through the filing of a document with a secretary of state or a similar office. Similarly, a foreign entity is classified as a reporting company only if it has registered to do business in the United States by filing a document with a secretary of state or an equivalent office.

State laws vary on whether certain entities, such as trusts, require the filing of a document with the secretary of state or a similar office for their creation or registration.

If a trust is established in a U.S. jurisdiction that mandates such a filing, then it is a reporting company unless an exemption applies. Likewise, not all states require foreign entities to register by filing a document with a secretary of state or a similar office to do business within the state. However, if a foreign entity must file such a document to register in a state, and does so, it becomes a reporting company unless an exemption applies.

Entities should also consider any applicable exemptions from the reporting requirements. For example, a foundation may be exempt from reporting beneficial ownership information to FinCEN if it qualifies for the tax-exempt entity exemption.

Chapter 1 of FinCEN’s Small Entity Compliance Guide (“Does my company have to report its beneficial owners?”) can help companies determine whether they are required to report

No, registering a trust with a court of law solely to establish the court’s jurisdiction over any disputes concerning the trust does not classify the trust as a reporting company.

Sometimes. A reporting company is defined as (1) any corporation, limited liability company, or similar entity created in the United States by filing a document with a secretary of state or a comparable office (making it a domestic reporting company), or (2) any legal entity registered to do business in the United States by filing a document with a secretary of state or a similar office (making it a foreign reporting company), provided it does not qualify for any of the exemptions outlined in the Corporate Transparency Act.

An entity’s activities, revenue, and other factors can sometimes qualify it for an exemption. For instance, there is an exemption for certain inactive entities and another for companies that reported more than $5 million in gross receipts or sales in the previous year and meet specific exemption criteria. Simply engaging in passive activities, such as holding rental properties, or being unprofitable does not necessarily exempt an entity from the beneficial ownership information (BOI) reporting requirements.

FinCEN’s Small Entity Compliance Guide offers further details on exemptions in Chapter 1.2, “Is my company exempt from the reporting requirements?”

No, a sole proprietorship is not considered a reporting company unless it was created (or, in the case of a foreign sole proprietorship, registered to do business) in the United States by filing a document with a secretary of state or a similar office. An entity is deemed a reporting company only if it was established or registered in the United States through such a filing.

Obtaining an IRS employer identification number, registering a fictitious business name, or securing a professional or occupational license by filing documents with a government agency does not create a new entity. Therefore, a sole proprietorship filing such documents does not become a reporting company.

Yes. In addition to companies in the 50 states and the District of Columbia, any company created or registered to do business in a U.S. territory by filing a document with a secretary of state or a similar office is required to report beneficial ownership information to FinCEN, provided it does not qualify for any exemptions. U.S. territories include the Commonwealth of Puerto Rico, the Commonwealth of the Northern Mariana Islands, American Samoa, Guam, and the U.S. Virgin Islands.

D. Beneficial Owner

A beneficial owner is an individual who either directly or indirectly: (1) exercises substantial control over the reporting company (see Question D.2), or (2) owns or controls at least 25% of the reporting company’s ownership interests (see Question D.4).

FinCEN’s Small Entity Compliance Guide provides checklists and examples to help identify beneficial owners (see Chapter 2.3, “What steps can I take to identify my company’s beneficial owners?”).

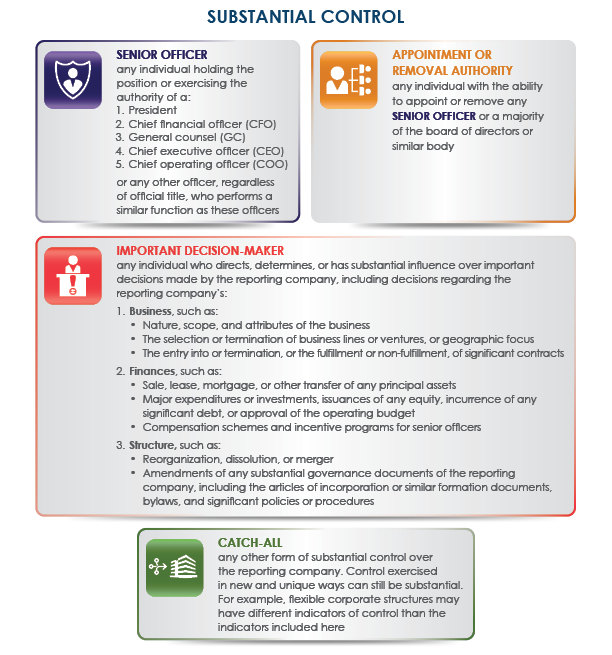

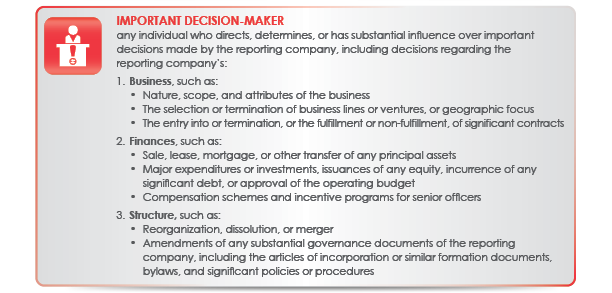

An individual can exercise substantial control over a reporting company in four distinct ways. If the individual meets any of the following criteria, they are considered to have substantial control:

-

The individual holds a senior officer position, such as president, chief financial officer, general counsel, chief executive officer, chief operating officer, or any other similar role.

-

The individual has the authority to appoint or remove certain officers or the majority of directors (or an equivalent governing body) of the reporting company.

-

The individual is a key decision-maker for the reporting company. For more details, refer to Question D.3.

-

The individual exercises any other form of substantial control over the reporting company as further described in FinCEN’s Small Entity Compliance Guide (see Chapter 2.1, “What is substantial control?”).

Important decisions encompass choices related to a reporting company’s business operations, financial management, and organizational structure. An individual who directs, determines, or has significant influence over these critical decisions is considered to exercise substantial control over the reporting company. For more detailed information, refer to Chapter 2.1, “What is substantial control?” in FinCEN’s Small Entity Compliance Guide.

An ownership interest typically refers to any arrangement that confers ownership rights in a reporting company. Examples of ownership interests include shares of equity, stocks, voting rights, or any other mechanisms that establish ownership.

There are five specific situations in which an individual, who would otherwise be considered a beneficial owner of a reporting company, qualifies for an exception. In these cases, the reporting company is not required to report that individual as a beneficial owner to FinCEN.

FinCEN’s Small Entity Compliance Guide provides a checklist to help determine whether any exceptions apply to individuals who might otherwise be considered beneficial owners (see Chapter 2.4, “Who qualifies for an exception from the beneficial owner definition?”).

Accountants and lawyers typically do not qualify as beneficial owners, although this can vary depending on the specific nature of their work.

Accountants and lawyers who provide general accounting or legal services are not deemed beneficial owners because ordinary, arms-length advisory services or other third-party professional services provided to a reporting company do not constitute “substantial control” (see Question D.2). Additionally, a lawyer or accountant designated as an agent of the reporting company may be eligible for the “nominee, intermediary, custodian, or agent” exception from the beneficial owner definition.

However, an individual serving as general counsel for a reporting company is considered a “senior officer” and is therefore a beneficial owner. FinCEN’s Small Entity Compliance Guide includes a checklist to help determine if an individual qualifies for an exception to the beneficial owner definition (see Chapter 2.4, “Who qualifies for an exception from the beneficial owner definition?”).

If a beneficial owner holds or controls their ownership interests in a reporting company solely through multiple exempt entities, then the names of all these exempt entities may be reported to FinCEN instead of the individual beneficial owner’s information.

It is important to note that this special rule does not apply when an individual owns or controls ownership interests in a reporting company through both exempt and non-exempt entities. In such cases, the reporting company must report the individual as a beneficial owner (if no other exception applies), but the exempt entities do not need to be listed.

FinCEN’s Small Entity Compliance Guide provides further details about this special reporting rule in Chapter 4.2, “What do I report if a special reporting rule applies to my company?”

An unaffiliated company cannot be a beneficial owner of a reporting company because beneficial ownership must be attributed to an individual. Any individuals who exercise substantial control over the reporting company through the unaffiliated company must be reported as beneficial owners. However, individuals who do not direct, determine, or significantly influence key decisions made by the reporting company, and do not otherwise exercise substantial control, may not be considered beneficial owners.

For additional information on determining whether an individual has substantial control over a reporting company, refer to Chapter 2.1 of FinCEN’s Small Entity Compliance Guide, “What is substantial control?”

No, a beneficial owner of a company is any individual who, directly or indirectly, exercises substantial control over a reporting company or owns or controls at least 25 percent of its ownership interests.

Whether a specific director meets these criteria is a determination that the reporting company must make on a director-by-director basis.

FinCEN’s Small Entity Compliance Guide provides additional information on identifying beneficial owners in Chapter 2, “Who is a beneficial owner of my company?”. This chapter contains sections with more details on substantial control (Chapter 2.1, “What is substantial control?”) and ownership interest (Chapter 2.2, “What is ownership interest?”).

It depends. A reporting company’s “partnership representative,” as defined in 26 U.S.C. 6223, or “tax matters partner,” as previously defined in the now-repealed 26 U.S.C. 6231(a)(7), is not automatically a beneficial owner of the reporting company. However, such an individual may be considered a beneficial owner if they exercise substantial control over the reporting company or own or control at least 25 percent of the company’s ownership interests.

Chapter 2 of FinCEN’s Small Entity Compliance Guide, “Who is a beneficial owner of my company?”, provides additional information on how to determine if an individual qualifies as a beneficial owner of a reporting company.

It’s important to note that a “partnership representative” or “tax matters partner” acting as a designated agent of the reporting company may qualify for the “nominee, intermediary, custodian, or agent” exception from the beneficial owner definition.

FinCEN’s Small Entity Compliance Guide includes more information on such exemptions in Chapter 2.4, “Who qualifies for an exception from the beneficial owner definition?”

If ownership of a reporting company is under active litigation and the initial beneficial ownership information (BOI) report has not been filed, an authorized person should fulfill the reporting requirements by including:

- All individuals who exercise substantial control over the company, and

- All individuals who own or control, or claim to own or control, at least 25 percent of the ownership interests in the company.

If an initial BOI report has already been filed, and the litigation’s resolution results in the reporting company having different beneficial owners than those previously reported (e.g., because certain individuals’ claims to ownership or control have been denied), the reporting company must file an updated BOI report within 30 calendar days following the resolution of the litigation.

Typically, a reporting company must report individuals who indirectly either (1) exercise substantial control over the reporting company, or (2) own or control at least 25 percent of the ownership interests in the reporting company through a corporate entity. The reporting company should not report the corporate entity itself if it is merely an intermediary for the individuals.

For an example of how to calculate the percentage of ownership interests an individual holds or controls in a reporting company through an intermediate entity, refer to Example 4 in Chapter 2.3, “What steps can I take to identify my company’s beneficial owners?” in FinCEN’s Small Entity Compliance Guide.

There are two special rules that create exceptions to this general requirement in very specific circumstances:

-

A reporting company may report the name(s) of an exempt entity or entities instead of an individual beneficial owner if the ownership interests in the reporting company are entirely held through the exempt entity or entities.

-

If the beneficial owners of both the reporting company and the intermediate company are the same individuals, the reporting company may report the FinCEN identifier and full legal name of the intermediate company through which an individual is a beneficial owner.

FinCEN’s Small Entity Compliance Guide provides additional details about these special reporting rules in Chapter 4.2, “What do I report if a special reporting rule applies to my company?”